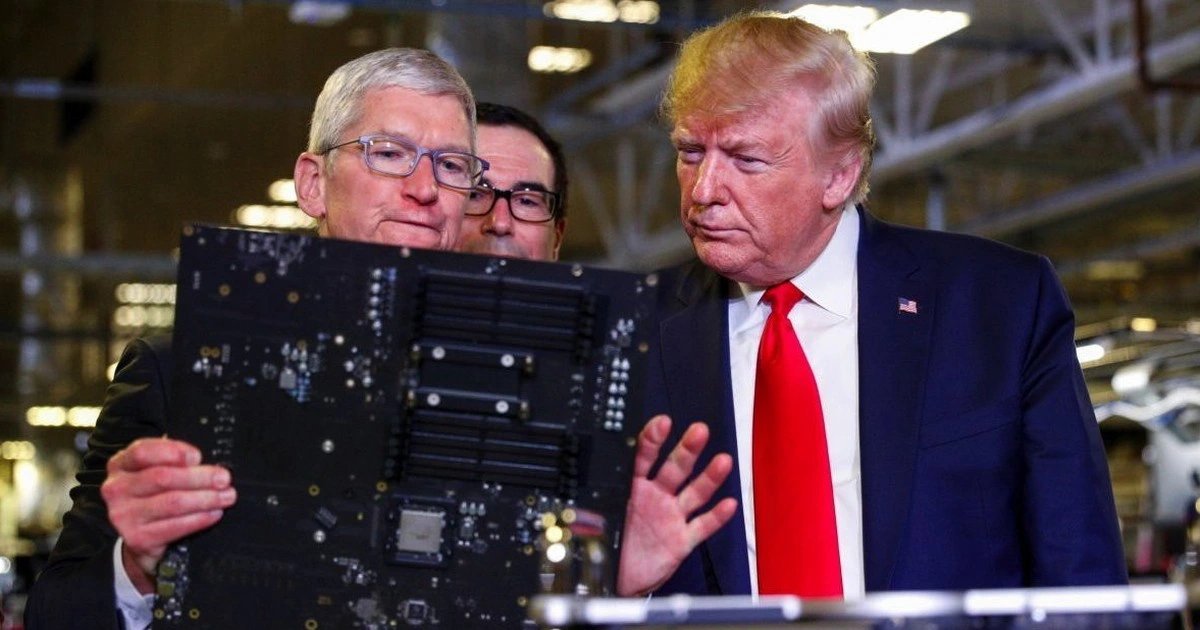

The smartphone industry, particularly Apple, is facing renewed uncertainty following former President Donald Trump’s announcement regarding a new wave of tariffs. These proposed tariffs are part of his broader trade agenda, which he claims aims to revive American manufacturing and reduce dependence on foreign imports, particularly from China. However, this aggressive stance could inadvertently drive up the cost of one of the world’s most popular consumer electronics — the iPhone.

As millions of Americans rely on iPhones for both personal and professional use, any increase in price could have wide-reaching effects, not only on consumers but also on Apple’s market position, the global supply chain, and the broader tech industry. This article explores how Trump’s new tariffs could make iPhones more expensive, and what that means for consumers, Apple, and the international economy.

## The New Tariff Proposal Explained

Trump’s new tariff proposal targets a wide range of Chinese-made goods, including consumer electronics, with the intention of bringing more manufacturing back to the United States. According to Trump’s plan, the tariffs could be as high as **60% on imports from China**, significantly increasing the cost of goods that are predominantly produced overseas.

Apple, though headquartered in Cupertino, California, relies heavily on Chinese manufacturing plants, including those run by Foxconn, for the production and assembly of its devices. Components for iPhones, such as chips, cameras, and screens, come from a global supply network, but the final assembly is mostly done in China. This means Apple will not be able to avoid the impact of these tariffs without overhauling its entire manufacturing structure — a costly and time-consuming process.

## How the Tariffs Will Affect iPhone Pricing

If the new tariffs go into effect, Apple will face a major dilemma: absorb the cost or pass it on to consumers.

Absorbing the tariffs would mean taking a hit to profit margins, something shareholders would not appreciate. Apple is known for its premium pricing and high profit per device, so any reduction in margins could significantly impact its valuation and investor confidence.

On the other hand, passing the cost to consumers would likely result in a noticeable price hike. According to analysts, the new tariffs could add **$100 to $160 to the price of an iPhone**, depending on the model. For example, the iPhone 15 Pro Max, which currently starts at around $1,199, could go up to $1,299 or more if Apple decides to fully shift the burden to consumers.

## The Potential Backlash from Consumers

Higher prices could cause a backlash among consumers, especially as inflation and economic uncertainty continue to strain household budgets. The iPhone, once seen as a luxury product, is now viewed by many as a necessity. If prices rise significantly, many customers may opt for older models, second-hand devices, or alternatives from competitors like Samsung or Google, which might not be as heavily affected by the tariffs.

This could erode Apple’s market share in the United States and abroad, especially in emerging markets where price sensitivity is even higher. A reduction in sales volume could also lead to lower revenues overall, even if the per-device margin remains the same or improves.

## Apple’s Supply Chain Dilemma

The real issue for Apple is its reliance on China. Over the years, Apple has built a complex and efficient supply chain centered around Chinese manufacturing. While this strategy has enabled the company to scale and maintain high production standards, it also makes Apple highly vulnerable to geopolitical shifts and trade policy changes.

In response to previous trade tensions, Apple began diversifying its supply chain, with limited success. Some iPhone production has moved to countries like India and Vietnam, but China remains irreplaceable in terms of scale, expertise, and infrastructure. Transitioning more of the supply chain away from China would take years and billions of dollars.

If Trump’s tariffs are reinstated and intensified, Apple may be forced to accelerate its diversification strategy, potentially leading to short-term production bottlenecks, increased costs, and disruptions in product availability.

## The Global Impact on the Tech Industry

Apple is not the only company that will feel the heat. Many U.S. tech companies rely on Chinese manufacturing and assembly for their products. Trump’s tariffs could trigger a domino effect across the tech industry, resulting in higher prices for laptops, tablets, accessories, and even electric vehicles.

Furthermore, the increased cost of tech devices could dampen consumer demand, slow innovation, and delay adoption of new technologies. This is particularly concerning at a time when 5G, AI, and augmented reality are poised to become mainstream and require cutting-edge hardware.

Internationally, trade tensions between the U.S. and China could escalate, prompting retaliatory tariffs, further disruptions in the global supply chain, and a decline in international cooperation on technology standards and intellectual property protections.

## Political and Economic Ramifications

Trump’s tariff policy is deeply political, aimed at energizing his base by emphasizing American sovereignty and economic independence. However, the economic consequences may outweigh the political benefits. While some domestic manufacturers may benefit in the short term, the broader economy could suffer from inflationary pressures and weakened international trade relationships.

Increased prices on consumer goods — especially something as ubiquitous as the iPhone — could contribute to overall inflation, placing additional pressure on the Federal Reserve and complicating monetary policy. The stock market, which often reacts negatively to trade uncertainty, could see increased volatility as investors respond to shifting expectations for corporate earnings.

## Apple’s Possible Strategic Responses

Apple is not without options. Historically, the company has shown remarkable adaptability in the face of regulatory, economic, and technological challenges. Here are a few strategies Apple might consider:

1. **Accelerate Supply Chain Diversification**: Moving more production to India, Vietnam, and even the U.S. could help reduce tariff exposure, though it would require long-term investment.

2. **Lobbying and Legal Action**: Apple could ramp up its lobbying efforts in Washington to seek exemptions or reduced tariff rates, as it has successfully done in the past.

3. **Price Differentiation by Market**: Apple could selectively increase prices in the U.S. while keeping them stable in other regions to maintain global competitiveness.

4. **Focus on Services and Subscriptions**: If hardware sales suffer, Apple could shift more emphasis to its growing services business, including iCloud, Apple Music, and the App Store.

5. **Introduce Budget-Friendly Devices**: Apple might introduce more affordable models like the iPhone SE to maintain sales volume and cater to price-sensitive customers.

## What Consumers Can Do

For consumers concerned about potential price increases, there are several steps to consider:

– **Buy Now**: If you’re in the market for a new iPhone, consider purchasing before tariffs take effect.

– **Consider Refurbished Models**: Certified pre-owned iPhones can offer significant savings.

– **Trade-In Old Devices**: Apple and many carriers offer trade-in programs that can reduce the cost of new devices.

– **Evaluate Alternatives**: Brands like Samsung, OnePlus, and Google offer high-quality smartphones at competitive prices.

– **Monitor News and Pricing Trends**: Stay informed about policy changes and market reactions to make strategic purchasing decisions.

## Conclusion

Trump’s proposed new tariffs could have a significant ripple effect throughout the tech world, with iPhones likely among the first casualties. For Apple, the threat of increased production costs and potential consumer backlash poses a serious challenge. For consumers, the prospect of paying more for their favorite devices adds yet another burden in a time of economic uncertainty.

As the situation unfolds, it remains to be seen how Apple, the government, and the market will respond. What is clear, however, is that the intersection of politics and technology has never been more crucial — or more costly — for both corporations and everyday consumers. Whether or not Trump’s tariffs achieve their intended goal of bolstering domestic manufacturing, they are certain to leave a lasting impact on the global smartphone industry.